Stock Market Performance During Presidential Election Years

Every four years the u s.

Stock market performance during presidential election years. But then the savings and loan crisis and gulf war struck. The economy and stock market surged in president george h. Bank analysts studied market data from the past 90 years and identified patterns that repeated themselves during election cycles.

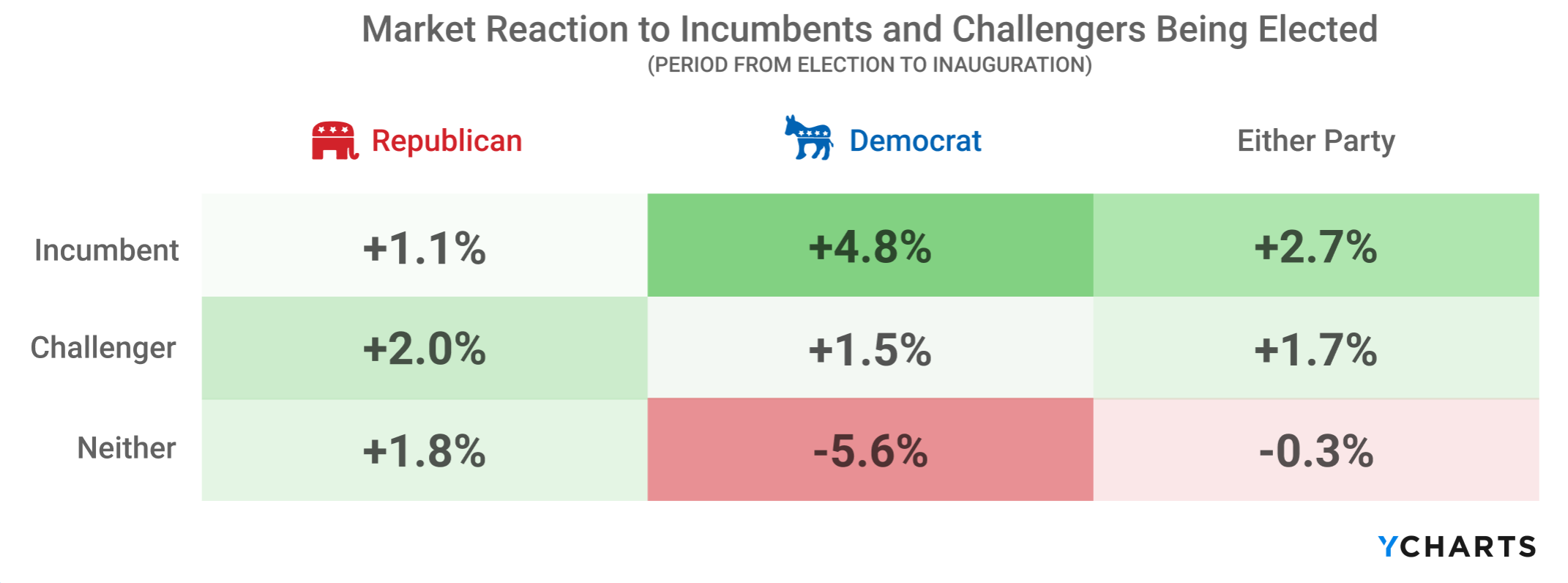

Since 1944 if the s p 500 rose in price from july 31 through october 31 of a presidential election year the incumbent party was re elected 80 of the time. Willkie 1944 19 7 roosevelt vs. From 1952 through june 2020 annualized real stock market returns under democrats have been 10 6 compared with 4 8 for republicans.

Looking at the performance of the s p 500 index for each general election year since 1928 the market has only had a negative return three times 13. Presidential election can have a major impact on policy laws and foreign relations. To better understand u s.

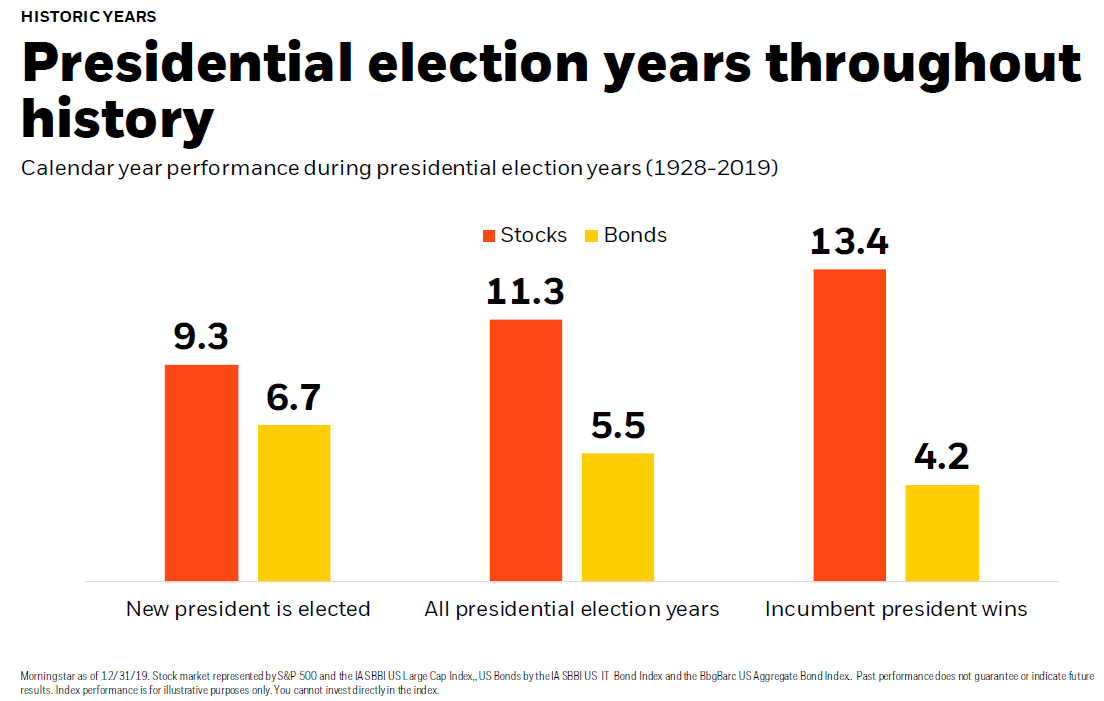

In fact a case could be made that general election years have correlated with positive market performance. Since 1952 the dow jones industrial average has climbed 10 1 on average during election years when a sitting president has run for reelection according to the stock trader s almanac which is. Bush s first year in office.

According to dan clifton of strategas research partners history. The s p 500 climbed 27 in 1989. Although volatility is often heightened during an election year historically returns tend to be higher as well.

If the market is down during the period the incumbent party lost the white house 86 of the time. But how do presidential elections affect the market. And how does that affect you.