Election Year Stock Market Performance

No matter which party wins the white house.

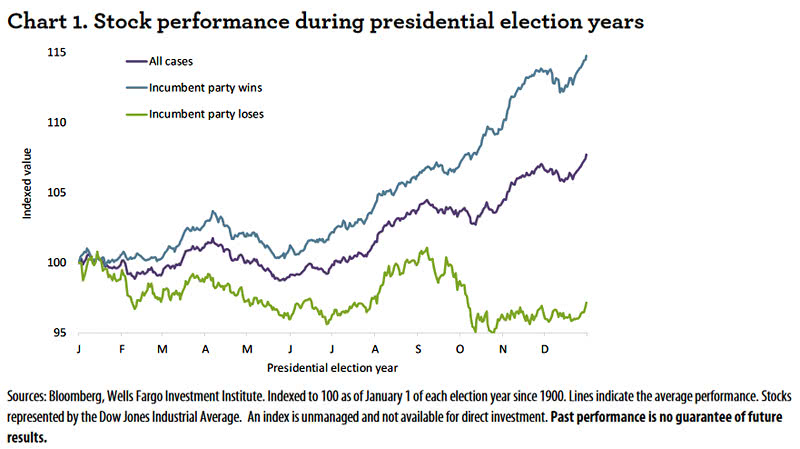

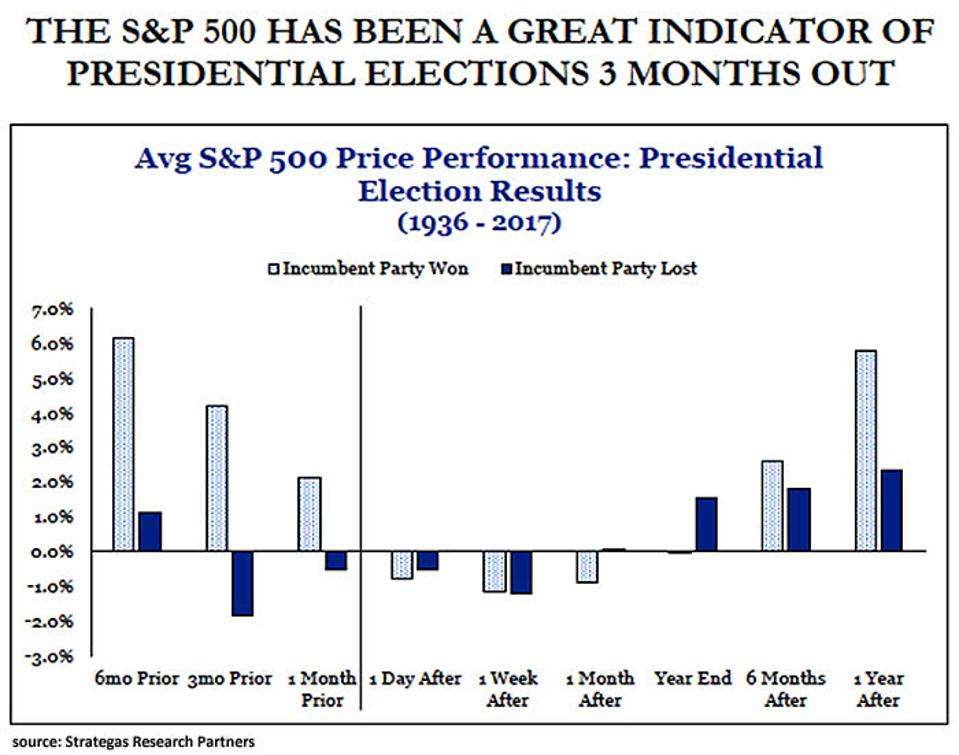

Election year stock market performance. From 1952 through june 2020 annualized real stock market returns under democrats have been 10 6 compared with 4 8 for republicans. However the historical average annual return for the s p 500 index since 1957 the year in which the index adopted 500 stocks is 7 96. The performance of the s p 500 in the three months before votes are.

There are exceptions of course. History suggests that us stock market returns are correlated with the presidential election cycle. Landon 1940 9 8 roosevelt vs.

Smith 1932 8 2 roosevelt vs. The first 2 years of a presidential term have been associated with below average returns while the last 2 years have been well above average. But there are some clear exceptions.

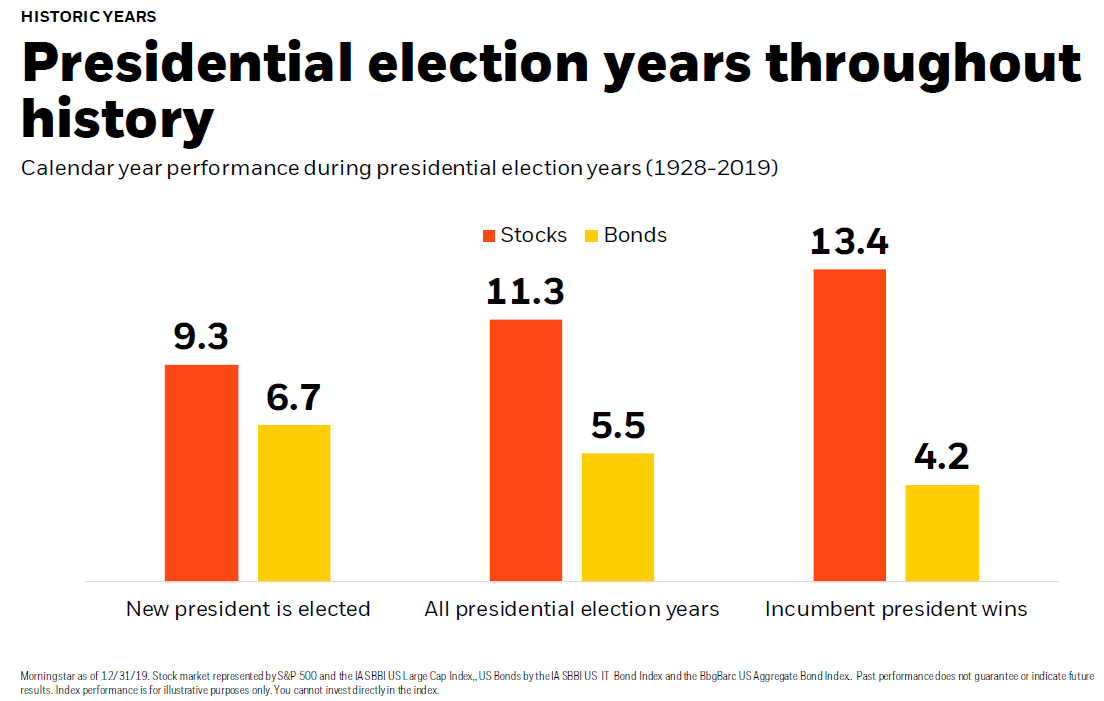

Stock market returns during presidential terms s p 500 index since 1929 only four presidential terms have experienced negative returns for the s p 500 on an annualized basis. S p 500 annual stock market returns during election years year return candidates 1928 43 6 hoover vs. Looking at the performance of the s p 500 index for each general election year since 1928 the market has only had a negative return three times 13.

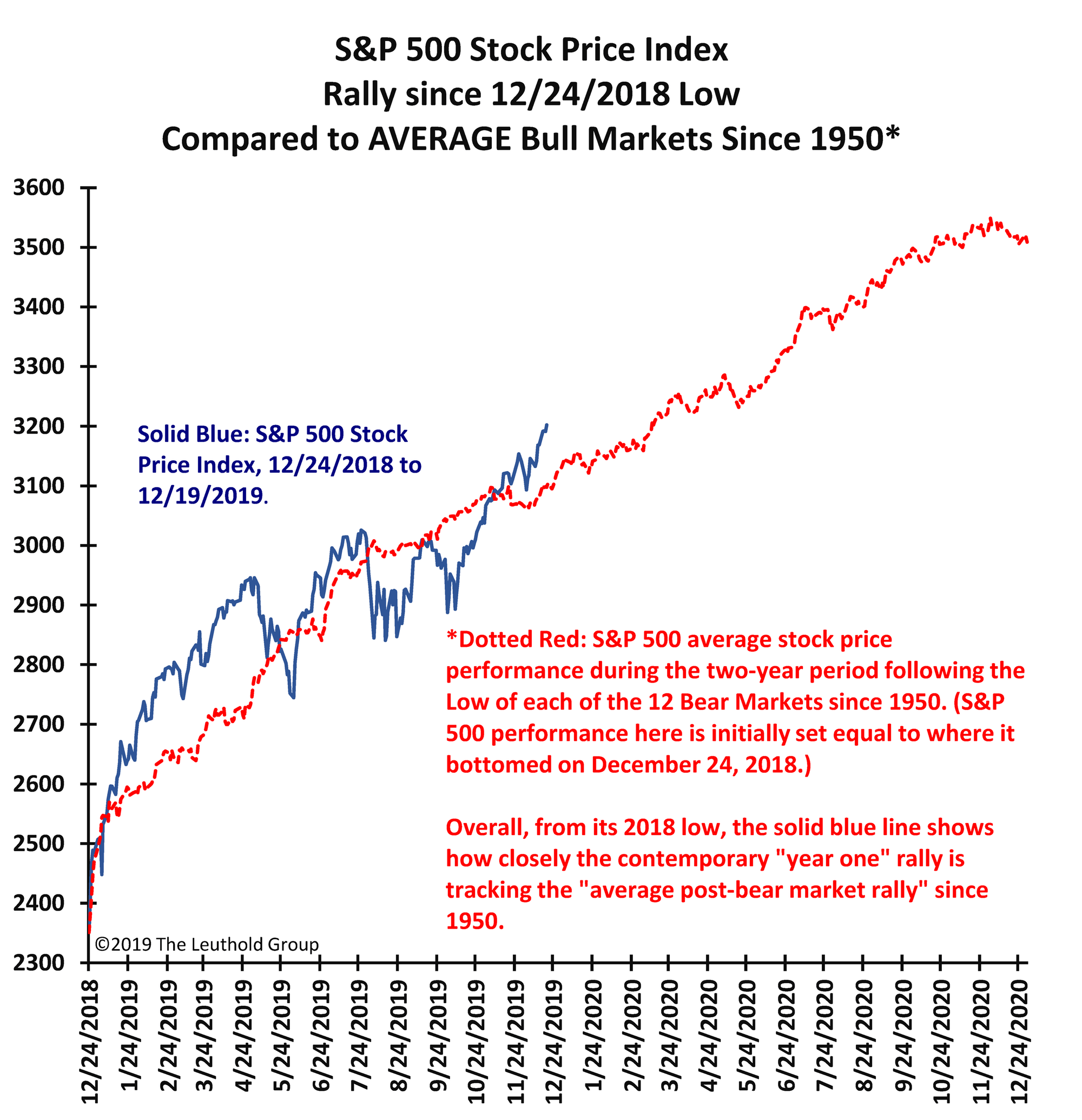

With the 2020 election less than four months away some. As of the writing of this blog the stock market is up a couple percentage points so far this year. His research also shows how stock market performance leading up to an election has also been a major indicator of the outcome.

The average annualized return for a president s term is over 10. The year before an election year is historically the strongest at 13 3 returns then things slow down considerably to 5 4 returns in election years. The average stock market performance in election years turns out to be positive 82 of the time.